Buying A Home-Yours or Landlords?

Buying a Home - Yours or Your Landlords?

You’re making monthly mortgage payments whether you know it or not. The question becomes are you making that payment on your behalf or that of your landlord. At VALoansMN we are prepared to demonstrate why it may be beneficial to you and your family to make that payment on your own behalf. It comes down to the choice between renting or buying a home with a VA loan.

There are some advantages to renting. First, and perhaps foremost, is the commitment to a property. There is little commitment as a renter. The landlord covers maintenance and repairs. You can walk away with little notice (generally 30 days unless there’s a lease involved. Being a tenant requires little up-front cost. This last point can also be said of buying your home with a VALoansMN home loan but more on that later.

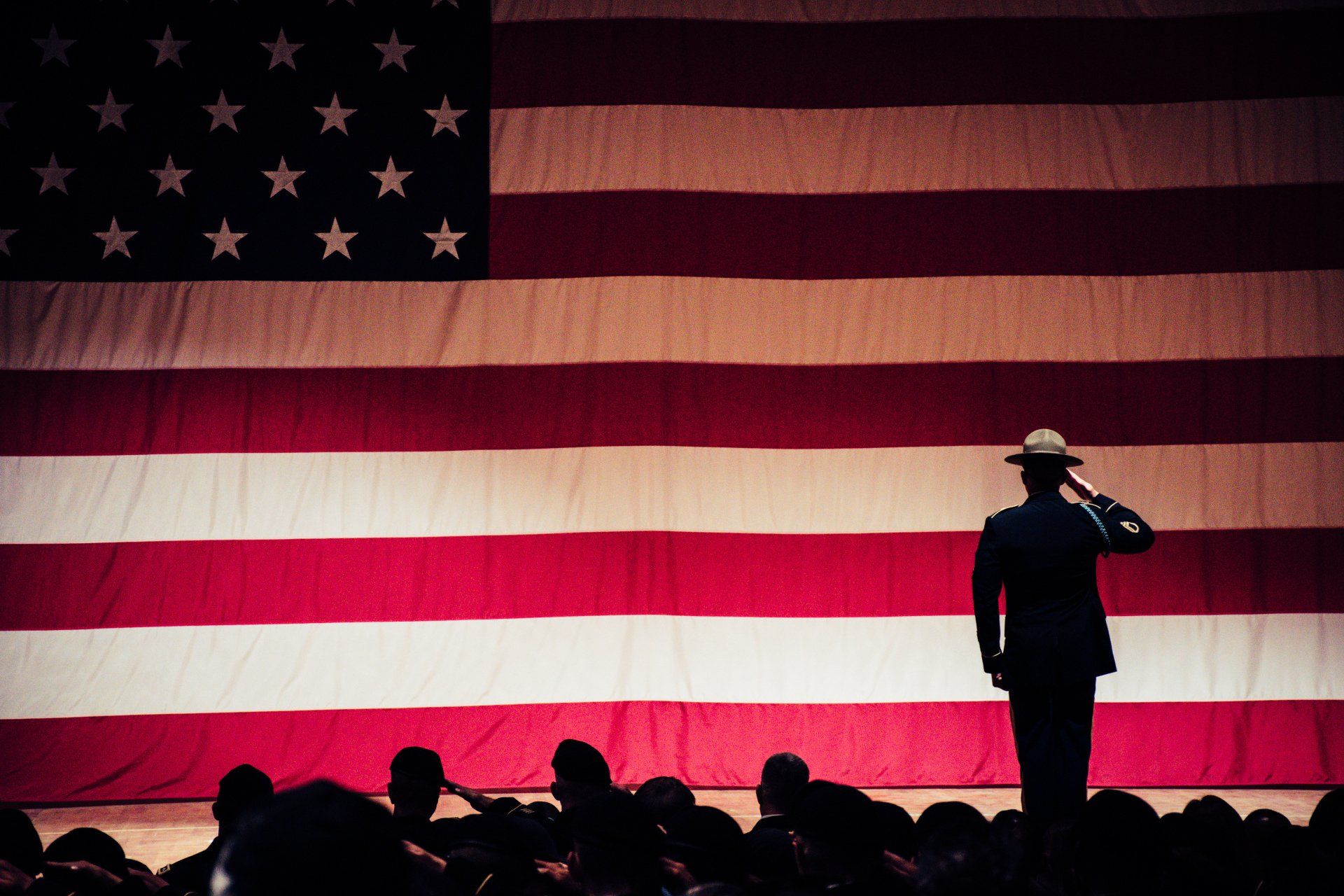

To be a homeowner requires some forethought. How long do you plan on staying, can you afford not only the monthly mortgage payment but the maintenance, repairs and taxes. However, the initial upfront costs is minimal thanks the benefits of a VA loan. The VA loan is a rare commodity reserved for those who have served in the U.S. armed forces. A home can be purchased with ZERO DOLLARS down and some of the fees can also be rolled into the loan. We have argued for years here at VALoansMN that this mortgage loan is a true gem in the world of home finance. Never mind where mortgage rates might be today.

As Brad Christensen says you marry the home but you’re only dating the mortgage loan. If rates go down you can refinance the loan. Talk to Brad about how easy that can be. So, as you make your monthly mortgage payment (or rent) ask yourself this: who am I buying this home for? Is my monthly payment purchasing the home (or apartment) for my landlord or for my family?