Don't Be Discouraged About Rates

Don't Be Discouraged About Rates

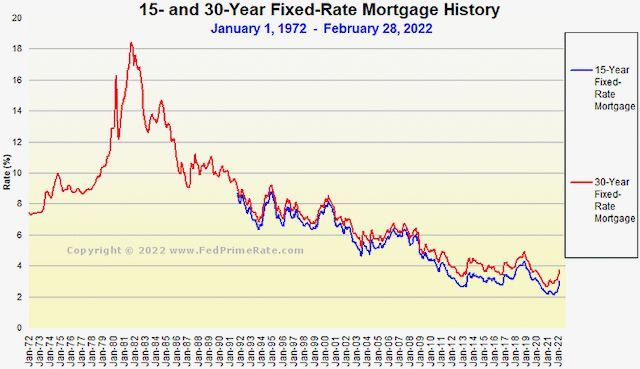

VA Mortgage rates have gone up but let’s cut through all the media noise and add some perspective. Yes, rates are certainly above their lows of a year ago but, looking at a much longer term than a year or two, we see there is still a reason to consider that VALoansMN refinance or purchase. Study this graph:

Given today’s rates you would see the right end of that graph above 4%. In fact, it has approached 5% which is a rate we last saw about 4 years ago. We remember homeowners coming to us to refinance because rates had dropped all the way down to 5%!

Our crystal ball does not show us the future. No one can accurately predict where rates might be by the end of the year or in coming years so perhaps a decision to purchase or refinance should not be based on recent history. Rates vary almost from hour to hour. When veterans reach out to us at VALoansMN we search lenders from coast to coast to find the best, most affordable rates available. Our number one priority is to help you plan for your financial future. Don’t let the recent mortgage rate past deter you from locking in what we still consider historically low VA loan rates. We are here for you