NO Monthly Mortgage Insurance

NO Monthly Mortgage Insurance

It’s a beautiful thing to be able to buy a home using your VA benefit borrowing 100% of the purchase price and NOT PAYING any monthly mortgage insurance fee like that required by an FHA or conventional loan. That is one of the several perks of a loan from VALoansMN. There are others but we’ll take this time to focus on borrowing 100% of a home purchase price with your VA loan.

Here’s some comparison numbers that make your VA loan benefit look even better. An FHA loan only requires 3.5% down. But you’re going to pay an upfront mortgage insurance premium equal to 1.75% of the loan amount. That’s not all. You’re also going to pay a monthly mortgage premium based on the loan amount. If the loan is less than $625,500 multiply your loan amount by .008 and divide by 12. For example:

$250,000X.008=$2,000/12=monthly mortgage premium of $166.67

Let’s repeat and emphasize: VA loan holders pay NO monthly mortgage premium. But you will pay an up front funding fee. At least, most people will pay this up front fee. Some don’t and we’ll explain who doesn’t have to pay any fee later. For now, let’s discuss your VA funding fee.

The funding fee paid up front can be rolled into the loan amount so you can actually borrow 100% of the purchase price PLUS your funding fee. Use these numbers to figure your funding fee:

If you put less than 5% down your funding fee is 2.3% of the loan amount. It decreases if you put more money down.

Money down:

5-9% the fee is 1.65% of the loan amount

10% or more the fee is 1.4% of loan amount.

The above figures are for first time users. If you’ve used your VA loan benefit before the funding fee is greater.

No money down the fee is 3.6% of the loan amount.

5 to 9% down the fee is 1.65%

10% or more the fee is 1.4%

Notice the fees for 5% or more for repeat users are the same as for first time VA loan borrowers.

Our discussion thus far has been about home purchasers. What if you are refinancing? If you’re simply wanting to lower your VA loan rate by refinancing your funding fee is .005 X Loan Amount regardless of prior use or service.

Earlier we suggested not everyone has to pay the up front funding fee. There are numerous exempt veterans. Here’s but a few:

- Purple Heart recipients

- Veterans who receive compensation for service related disabilities

- Veterans who would receive disability payments if they didn’t have retirement pay

- Surviving spouses eligible for a VA loan

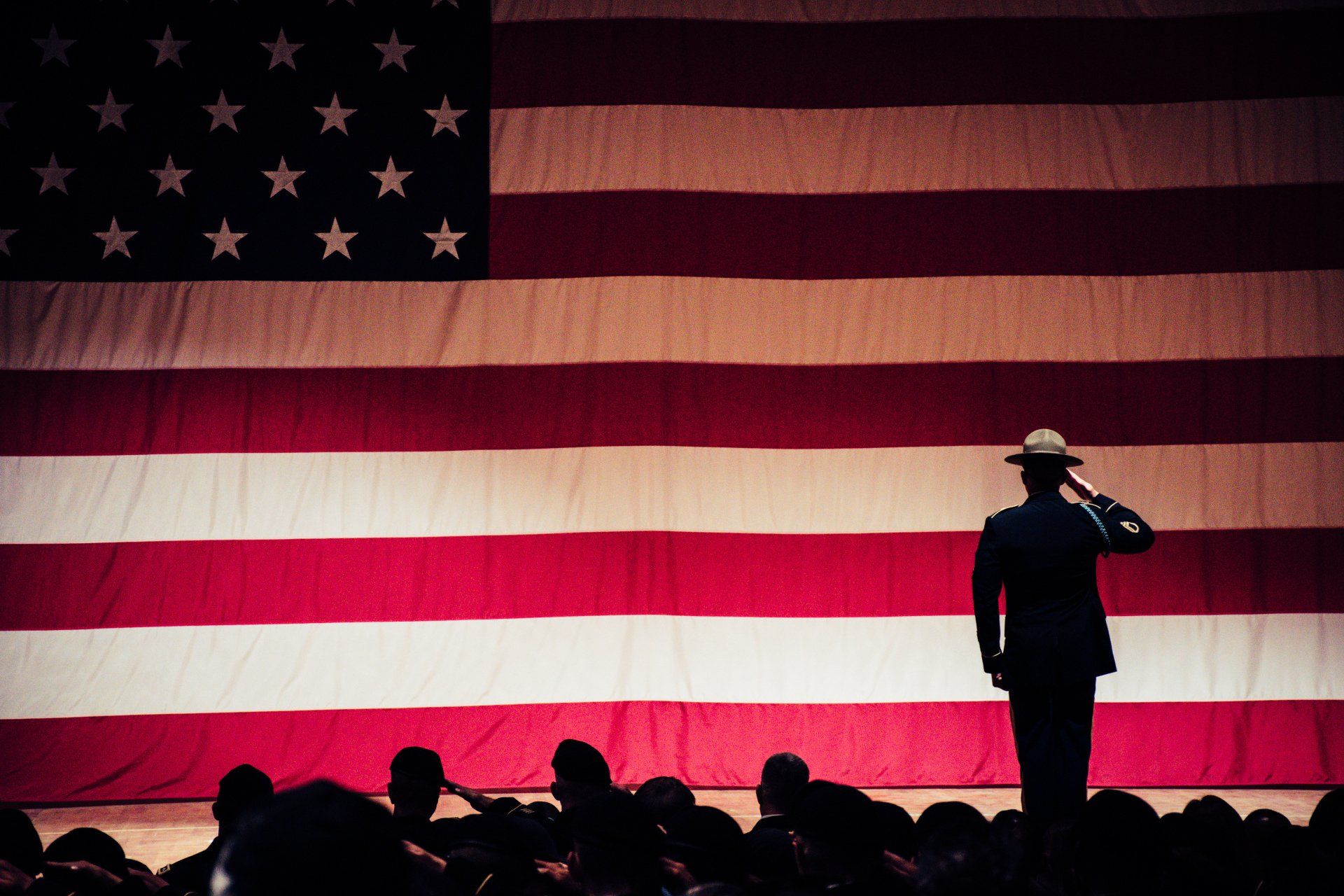

We hope this may give you an accurate picture of the great benefit you receive thanks to your service. We encourage you to call Brad at VALoansMN/Luminate Home Loans to discuss your personal situation. He is here to help you reach you home financing goals.