LOCK AND LOAD: Be Ready to Make Your Move

LOCK AND LOAD: Be Ready to Make Your Move

Here’s the choice: you have money stuck away in a mutual fund that’s been appreciating at about 7% a year. A veteran can borrow money to buy (or refinance) a home for under 3%. What’s a better choice, taking money out of your mutual fund or using OPM (Other People’s Money) for a home purchase? If you answered OPM then you get a gold star from most financial planners.

The Federal Reserve is indicating they see no change in low interest rates in the foreseeable future. This is very, very good news for our V.A. loan home buyers. In the not too distant past we were urging veterans to take advantage of low V.A. loan rates because they were sure to rise. We no longer take that position. Now we urge veterans to shop for a home wisely taking your time to find the right house. We believe you are not about to see any dramatic increase in V.A. home loan rates anytime soon.

As you begin your search start with us at VALoansMN. Every home shopper should be armed with a pre-qualification letter. This letter puts you in a very strong position when your offer to buy is put to sellers. Even more than that, it puts you in a strong position as you select a real estate agent. Any agent is more likely to work with a home shopper who comes armed with a pre-qualification letter from VALoansMN. What does it take to have this letter? Only a phone call and a short conversation.

When you call us (612-240-9922) we will ask about your current financial situation; do you have any savings, a checking account, a steady job or are you self employed. We ask about any outstanding loans such as a car loan or credit cards. We will ask for your current address and social security number. Then we put all the available information into our system and run a credit report. Do not be afraid of this! VA loan requirements are not as stringent as you may think.

It is possible to get a VA loan even with what you may consider bad credit. First, a reminder. The V.A. is not the lender. The V.A. only guarantees or backs up your loan from a bank or other financial institution. Our lenders look beyond a credit score. They want to see your loan or credit card payment history. Do you make payments on time? They want to see how long you’ve been employed. If you’re self employed they want to know how long you’ve been in business. Do you have any bankruptcies or foreclosures in your past. Not to worry. Our job is to put together your loan “package” and present it in the best light to lenders.

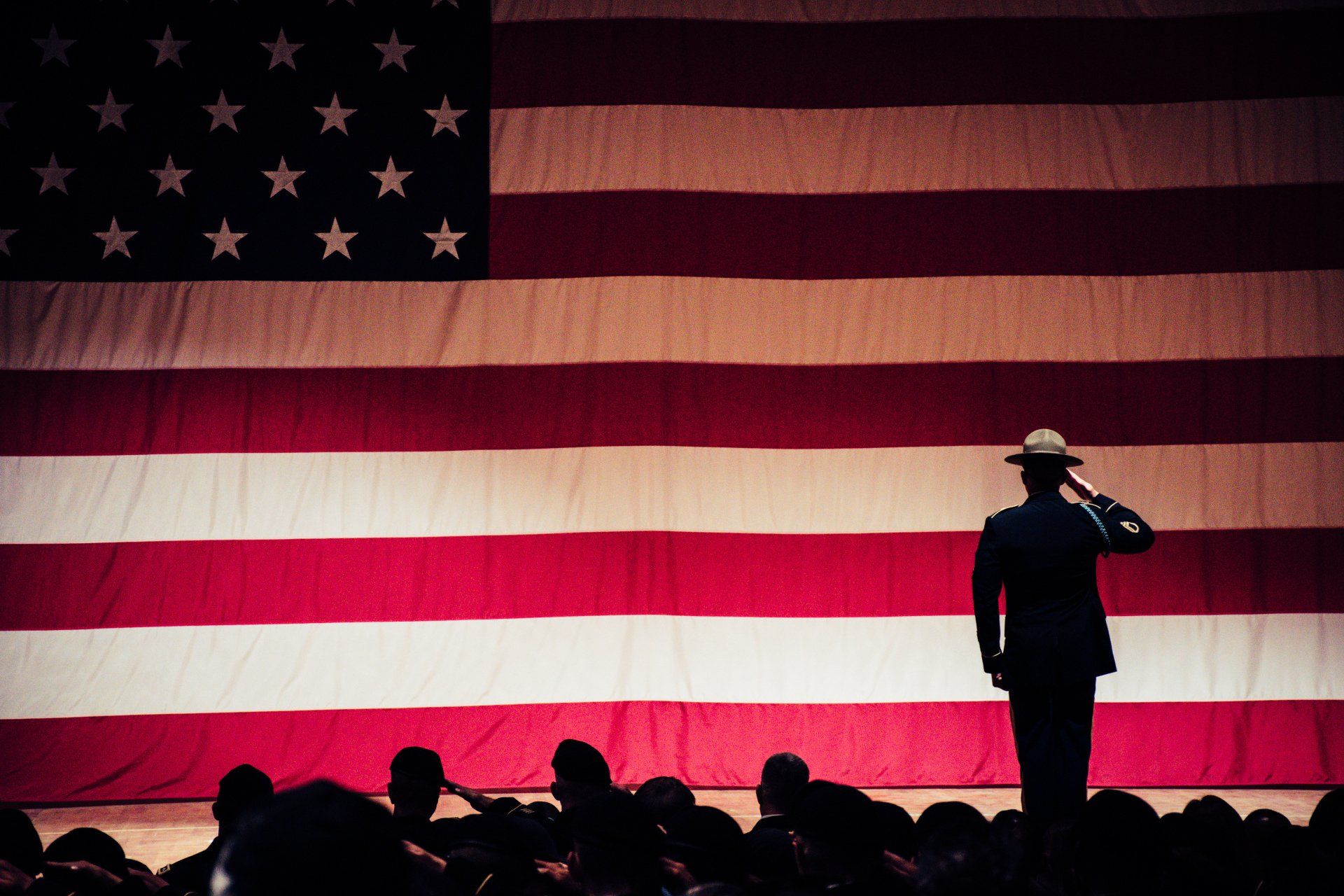

Our goal is find you the best loan possible. We want to make sure you get the best interest rate at the lowest cost. This is our responsibility to you. We also want to ensure you have a V.A. loan you can afford. This why so many Minnesota, Dakota and Wisconsin veterans turn to VALoansMN. We have the experience and knowledge to get it done right. Let us get it done for you today. Pick up the phone and call Brad. There’s never been a better time to take advantage of this great benefit you earned when you served us all in uniform. Now let us serve you.