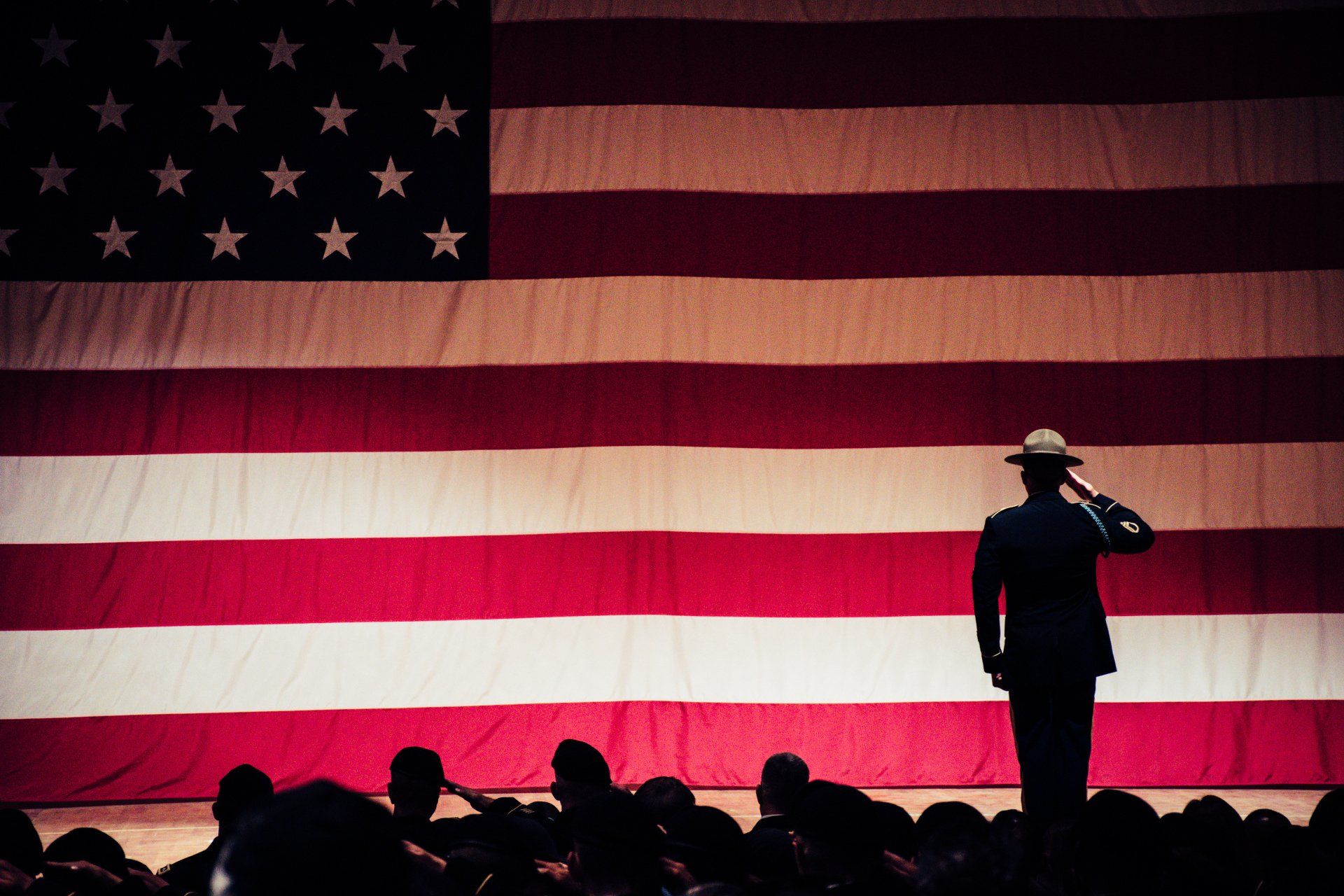

VA Loans in a Sellers' Market

VA Loans in a Sellers' Market

Well, just when you thought the real estate and mortgage market couldn’t get any crazier, it does. First let’s look at your prospects of using your VALoansMN mortgage to buy a home.

We are definitely in a sellers’ market. That’s good news and not so good news. The good news is if you are now a homeowner wanting to move up, down or sideways you’ll likely get more money for your house that you would’ve just a few months ago. The not so good news is, you’re now a buyer and you’re going to have to find a house to buy. While your house has been going up in value so have the homes you may want to buy. If you’re buying, you’d better have all your ducks in a row.

The first thing you want to do is call Brad at Luminate Home Loans. That’s the company umbrella where you’ll find VALoansMN. Brad is a VA loan specialist. We don’t mean he just “does” VA loans. We mean he specializes in them. He knows the ins and outs. He knows how to get it DONE. Why is this the first thing to do? Because you’re going out into a sellers’ market to buy your next (or first) home and you’d better be prepared. By preparation we mean you’d better be able to show the seller of the home you want that you are qualified to buy it. A seller wants to know that on the day of closing their money will be there. Brad can help you with this. It’s called “pre-qualification”.

Brad can guide you through this process over the phone. He’ll ask you questions about your financial situation, your job history, your income, your debts. He puts all this info together and he can tell you how much of a loan you can qualify for. He will give you a pre-qualification form or letter which you give to your real estate agent. The agent will bundle that up with your offer to buy a house and present it to the seller. A good real estate agent will supplement this paperwork by telling the sellers’ agent why you should be the one to get the home. There’s a reason for this and we’re going to share some real estate secrets here.

Let’s say you’re a home seller and you get more than one offer (this is likely to happen in today’s market). One of the offers the buyer is using a conventional mortgage and putting down 40 or 50% in cash. The other buyer is using a VA loan and financing 100% of the purchase price. Which buyer, in your opinion, is the more qualified to buy the home? Here’s our answer and the answer we hope you’re real estate agent would have. Both buyers are qualified because on closing day what comes to the seller is ALL CASH. The VA loan represents a buyer who has served the country. The VA loan comes from a lender just like a conventional mortgage except the VA loan has backing from the federal government. That protects the lender from loss. So the one buyer may have a conventional mortgage and money in the bank but the VA Loan buyer is, to some degree, being backed by the Federal Government.

When you select a real estate agent to represent you in this sellers’ market make sure this person is a believer in the use of VA loans. Make sure they can tell that seller why YOU are the one that should get the home. It may make the difference between two (or more) almost identical offers.

Now, pick up the phone and call Brad who is a loan officer that is a believer in VA Loans, who knows how to get it done and will be a major player on your home purchase team. Here’s his number: 612-240-9922. He’s waiting on your call.